First off, we want to congratulate Cvent on their recent acquisition of Splash, one of the fastest-growing event management platforms. This acquisition is certainly a big move in the event tech space.

For those unfamiliar, Cvent is a leading event management platform, known for providing comprehensive solutions for corporate events, meetings, and more. The company was acquired by Blackstone for a whopping $4.6 billion in 2023, after being publicly traded on NASDAQ under the ticker CVT. Since then, Cvent has continued to expand its footprint in the events industry, and this acquisition is a major part of that strategy.

As for Splash, according to their LinkedIn page, it’s a powerful tool that allows users to create, manage, and market events all in one platform. It’s been a favourite for many marketers and event planners, thanks to its simplicity and flexibility.

Cvent, The salesforce of event tech

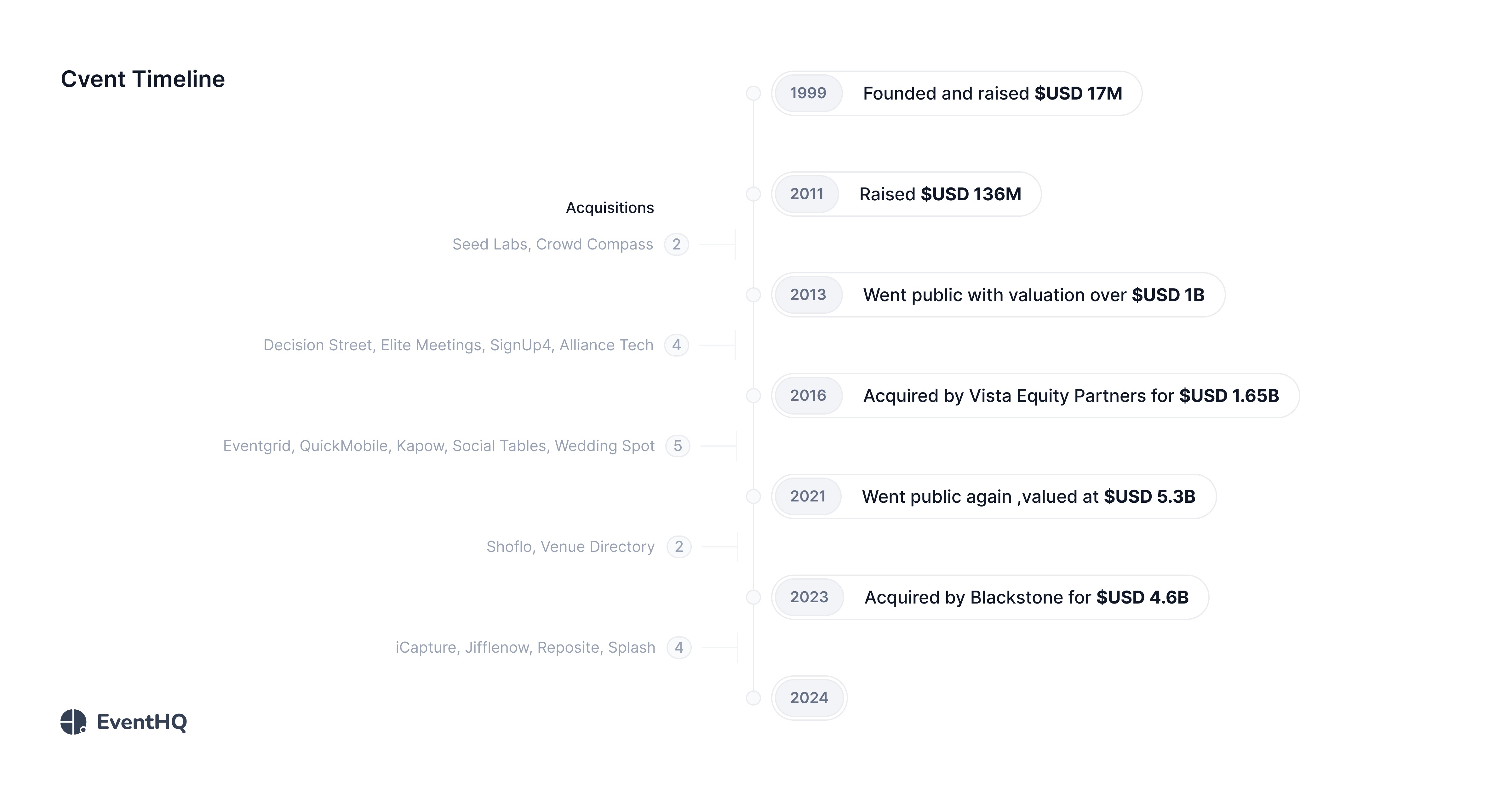

Cvent was founded in September 1999 by Reggie Aggarwal. That same year it received $17 million in venture capital and grew its staff to 125 employees.

Following the dot-com bubble burst and the September 11 attacks, Cvent faced near-bankruptcy and was forced to cut 80% of its staff. The company became profitable again by 2003.

In 2011, Cvent was growing by 50% a year and received $136 million of funding from New Enterprise Associates in July 2011, which, at the time, was the largest investment in a U.S. software company since 2007.

In 2013, Cvent went public on the New York Stock Exchange on August 9, at an initial price of $21. The company raised $117.6 million and received a market capitalization of more than a billion dollars.

In 2016, the company was acquired by venture capital company Vista Equity Partners for $USD 1.65 billion.

In 2021, Cvent merged with a blank-check firm in a deal that gives it an enterprise value of $5.3 billion, returning to the public markets five years after it was taken private.

In 2023, Cvent got acquired by Blackstone at a value of approximately $4.6B

A Strategic Acquisition: Why Cvent Needed Splash

This acquisition isn’t just another transaction—it’s a strategic play by Cvent. Splash was quickly becoming one of Cvent’s biggest competitors, especially when it came to event management for mid-market and fast-growing companies. Splash has been in the market for almost 10 years and they will definitely move upmarket to enterprise, with Splash offering a user-friendly platform that catered to event marketers, it will pose a significant challenge to Cvent, which primarily targets enterprise-level clients.

By acquiring Splash, Cvent is removing one of the fastest-growing competitors from the playing field, solidifying their dominance in the event tech space. This acquisition will likely allow Cvent to tap into Splash’s more marketing-focused user base, expanding their reach into new market segments.

The Pandemic’s Impact on the Event Tech Space

The pandemic changed the event industry in unprecedented ways. With lockdowns and restrictions in place, there was an over-reliance on virtual events as the primary medium for interaction. During this period, many event tech companies emerged to meet the demand, resulting in significant revenue spikes for virtual event platforms.

Cvent, having existed since 1999 and already dominating the in-person event space, quickly offered virtual solutions, allowing them to maintain their strong market presence. While their in-person event revenue took a hit during the pandemic, their virtual event revenue shot up, cushioning any financial impact. Once the world reopened, Cvent’s in-person event revenue naturally rebounded, ensuring they remained largely unaffected by the market’s shift.

For virtual-only platforms like Hubilo, Hopin, and Airmeet, the story was very different. These companies were born out of the necessity for virtual events, and many saw meteoric revenue growth during the pandemic. For instance, Hopin was valued at $3.85 billion during its peak. But as the world returned to in-person events, these companies struggled to retain that growth. Without a solid foothold in the in-person events market, their revenue slumped sharply, with Hopin ultimately being sold for as low as $15 million.

This shift highlights the vulnerability of companies solely reliant on virtual events. While Cvent was able to capitalize on both virtual and in-person events, many of these newer platforms lacked the flexibility to adapt once the demand for virtual events declined. For companies like Splash, which have now been acquired by Cvent, this is a pivotal moment where consolidation is likely to lead to higher prices as they seek to recoup the losses of declining virtual event demand.

What Does This Mean for Event Organizers?

While this acquisition is a smart business move for Cvent, it could mean big changes for event organizers—particularly when it comes to pricing.

1. Expect Price Hikes

Acquisitions come with significant costs, and companies will typically increase prices to justify the money spent. This means you can expect to see price hikes for many of the features that were once affordable under Splash’s platform. We’ve seen it happen before—once the dust settles, even the most basic features often come with inflated costs.

2. High Costs for Simple Features

Let’s be real: some companies are already paying exorbitant prices for basic functionalities within Cvent. Imagine paying multiple dollars for each registration—just for an API ping to print a badge!

This is an unnecessary burden for event organizers, especially considering how much simpler and more cost-effective these features should be. Badge printing is a critical component of event management, but it shouldn’t come with a hefty price tag.

We Believe You Shouldn’t Have to Pay So Much

At EventHQ, we believe event organizers shouldn’t have to pay premium prices for essential tools. Whether it's badge printing, unlimited registrations, lead scanning, or photo sharing, we offer all these features at a much lower cost—without sacrificing quality or functionality.

Our goal is simple: we want to provide you with the tools to run successful events, without the heavy financial burden that comes with price hikes like those likely coming from Cvent/Splash.

Special Offer: 6-Month Free Subscription for Splash Users

For event organizers who are considering moving away from Splash in light of this acquisition, we have some great news. To make the transition easier, we’re offering a 6-month free subscription to our platform for all former Splash customers. That means you’ll get access to our full suite of event management tools—badge printing, lead scanning, and more—at no cost for the first six months.

We believe in making event management affordable, without compromising on the features you need to create memorable experiences for your attendees.

If you're ready to make the switch, we’re here to help you every step of the way. Let’s talk about how we can help you transition smoothly, avoid unnecessary price hikes, and keep your events running seamlessly.